Lawmakers are starting to move on their plan to cut taxes for a 5th straight year.

On Tuesday morning, the House Revenue and Taxation Committee takes up HB106 from Rep. Kay Kristofferson, which drops the state's income tax rate from 4.55% to 4.45%.

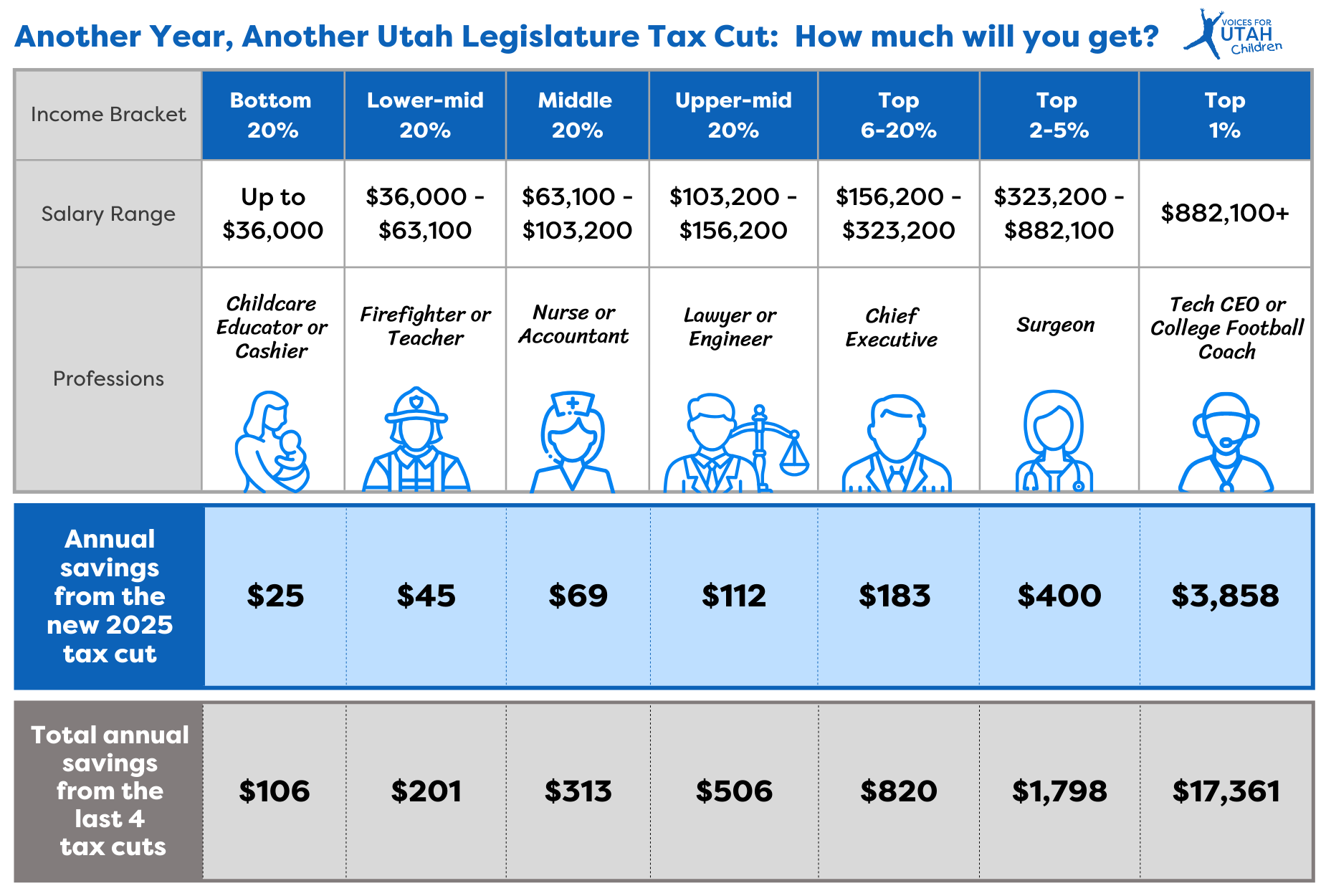

Just like past income tax rate reductions, Kristofferson's proposal would mostly benefit the wealthiest Utahns.

According to an analysis from Voices for Utah Children, the top 5% of income earners in Utah would see about $400 per year in tax savings, while the top 1% – those who earn $882,000 annually or more – would see their taxes drop by approximately $3,858 per year.

The cut for the bottom 80% of Utah taxpayers would be anywhere between $25 and $183 annually. The average Utah household with an income of $91,750 would save just under $70 per year. According to the U.S. Census Bureau, the average individual taxpayer in Utah earns around $40,ooo, which would result in annual savings of about $45.

Unsurprisingly, the top income earners saw the lion's share of tax savings from the tax cuts approved by lawmakers over the last four years. Since 2020, the top 1% of income earners have seen their state income taxes drop by about $17,361. This year's proposed 0.1% reduction would increase that total to more than $20,000.